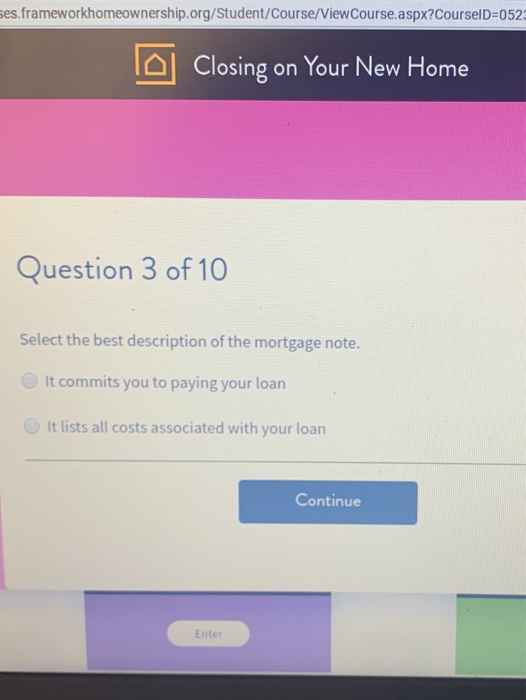

select the best description of the mortgage note. chegg

A mortgage note is the document that you sign at the end of your home closing. I clean the grates and the smoker after every coo.

/balloon-loans-315594-cadd06e3bbe046d39311cd4be59d794c.gif)

How Balloon Loans Work 3 Ways To Make The Payment

Purchase money mortgage B.

. A mortgage note is the document that you sign at the end of your home closing. N can expect the hypothecreate with all the following with a mortgage. A promissory note is essentially a signed IOU.

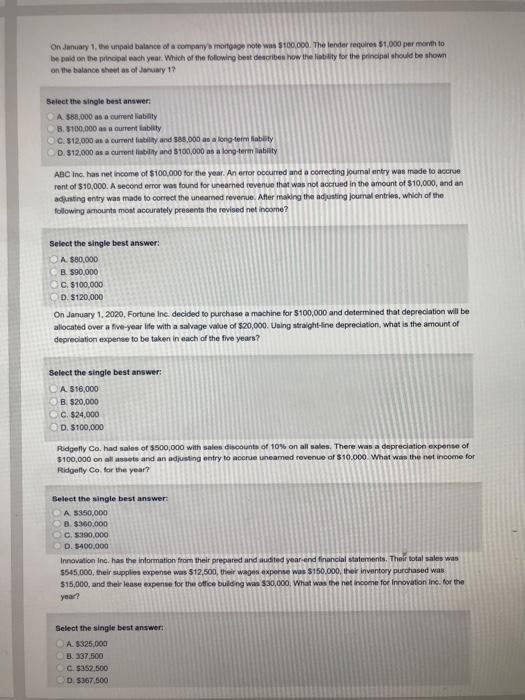

See the answer See the answer done loading. I clean the grates and the smoker after every coo. Select the best description of the mortgage note.

Select the best description of the mortgage note. Chegg Which one of this documents itemizes the closing cost and explains the terms of your loan. Select the best description of the mortgage note.

It shapes the relationship between all parties outlining the ownership of the property the interest rate and all other. A promissory note is essentially a signed IOU. A mortgage note is a note promising to repay a stipulated amount of money as well as interest incurred at a stipulated rate at an agreed time in order to live up to the terms of the promise.

It commits you to paying your loan It lists all costs associated with your loan. Who are the experts. Select the best description of the mortgage note.

Your mortgage note lays out all the specifics of your loan including the following. I clean the grates and the smoker after every coo. Select the best description of the mortgage note.

Lot but not the house. Posts Atom Popular Posts. C Over 80 percent of mortgage loans finance residential home purchases.

It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesnt. The mortgage note outlines the debt and the interest rate and requires the borrower that is the signatory to the note individually responsible for the repayment of the. At the closing they will make a cash payment of 40000.

House but not the lot. Page 3 of the Settlement Statement is a comparison of the fees disclosed on the Good Faith Estimate to the actual costs listed. A mortgage note is a legal contract between the borrower the lender and any cosigners who sign-on.

The Blacks have given an earnest money deposit of 5000. The HUD or Settlement Statement itemizes all closing costs. House but not the lot.

Experts are tested by Chegg as specialists in their subject area. I clean the grates and the smoker after every coo. Chegg Which one of this documents itemizes the closing cost and explains the terms of your loan.

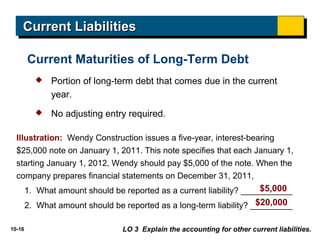

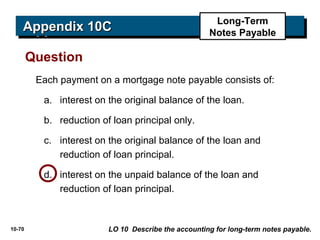

Which one of this documents itemizes the closing cost and explains the terms of your loan. B A borrower pays off a mortgage in a combination of principal and interest payments that result in full payment of the debt by maturity. The definition of a mortgage note.

Many brides-to-be who choose red for their. Chegg Which one of this documents itemizes the closing cost and explains the terms of your loan. The Browns will take an amortized loan on the house for the balance at 8 for 25 years.

On pages 1 and 2 items that appear on this statement include real estate commissions loan fees points paycheck and escrow amounts. Select the best description of the mortgage note. Ns other real estate holdings.

A mortgage note is a type of promissory note used specifically in mortgage loans. 16 N wishes to purchase Ws house for 100000 giving her a 20000 cash down payment in a note and mortgage for the remaining 80000. Chegg Which one of this documents itemizes the closing cost and explains the terms of your loan.

Select the best description of the mortgage note. Read on for more information on what a mortgage note is and how your repayment plan affects who owns it. D All of the above are true of mortgages.

This mortgage arrangement is best described as a Select one. Equipment with an estimated market value of 30000 is offered for sale at 45000. April 11 2022 Edit.

I clean the grates and the smoker after every coo. We review their content and use your feedback to keep the quality high. It is a document held by your lender that states that you also called the maker or the borrower or the promiser promise to repay your lender also called the payee or the holder or the promisee.

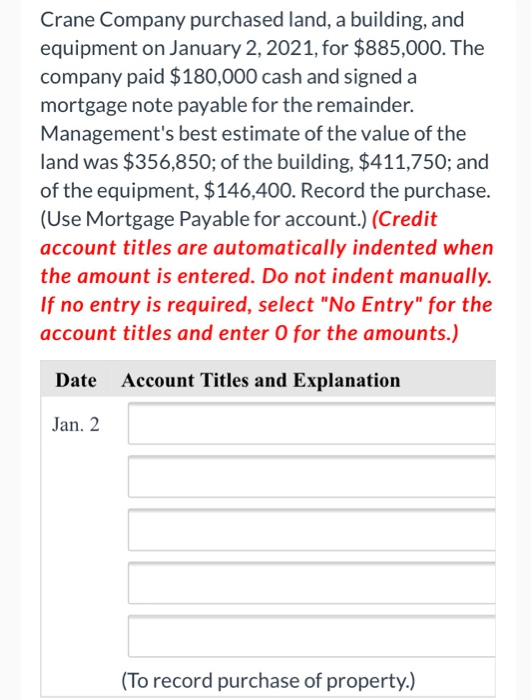

Terms of your loan eg 30-year fixed or. Select the Best Description of the Mortgage Note When you are a borrower you must understand the mortgage note. The equipment is acquired for 15000 in cash and a note payable of 20000 due in 30 days.

A A mortgage is a long-term loan secured by real estate. The amount used in the buyers accounting records to record this acquisition is. The Mortgage Note is a news site dedicated to reporting on the latest news insight and trends around the mortgage and housing industries.

Which one of this documents itemizes the closing cost and explains the terms of your loan.

Solved 5 03 Olte Closing On Your New Home Question 1 Of 10 Chegg Com

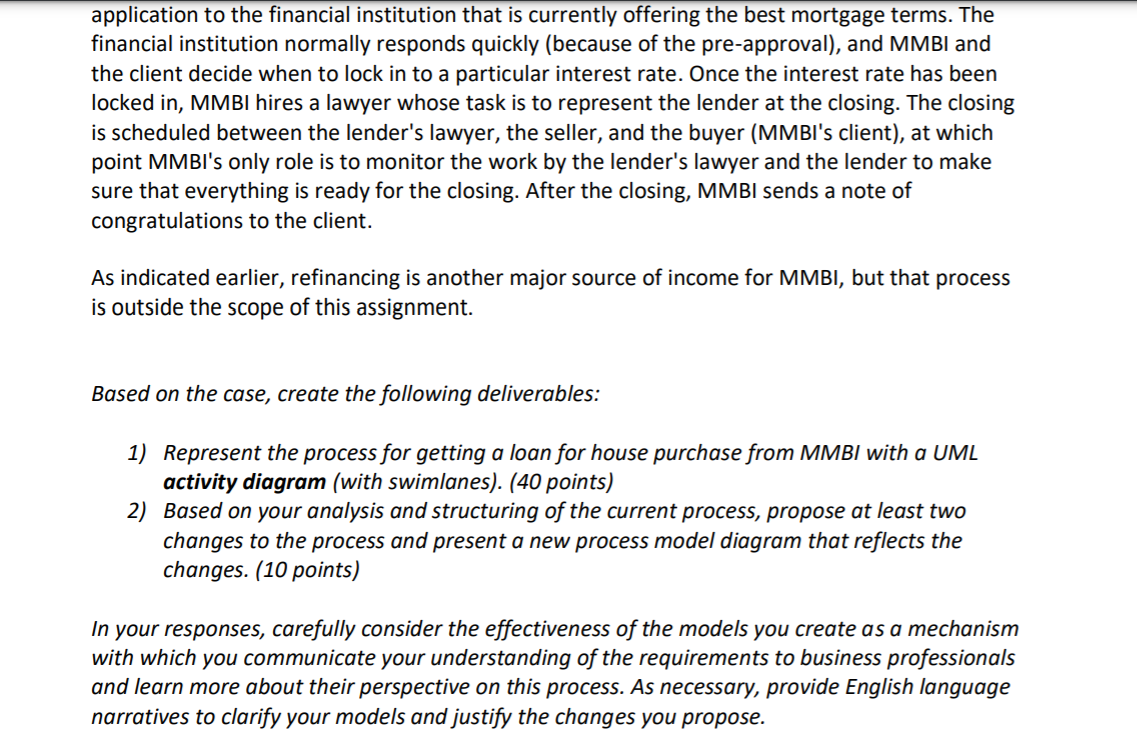

Solved Master Mortgage Broker Inc Mmbi Is Small Mortgage Chegg Com

Benefits Of Refinancing Your Va Mortgage Nextadvisor With Time

Was Your Loan Denied Here S What To Do Forbes Advisor

Sallie Mae Review Private Student Loans For All Levels Of Higher Ed Student Loan Hero

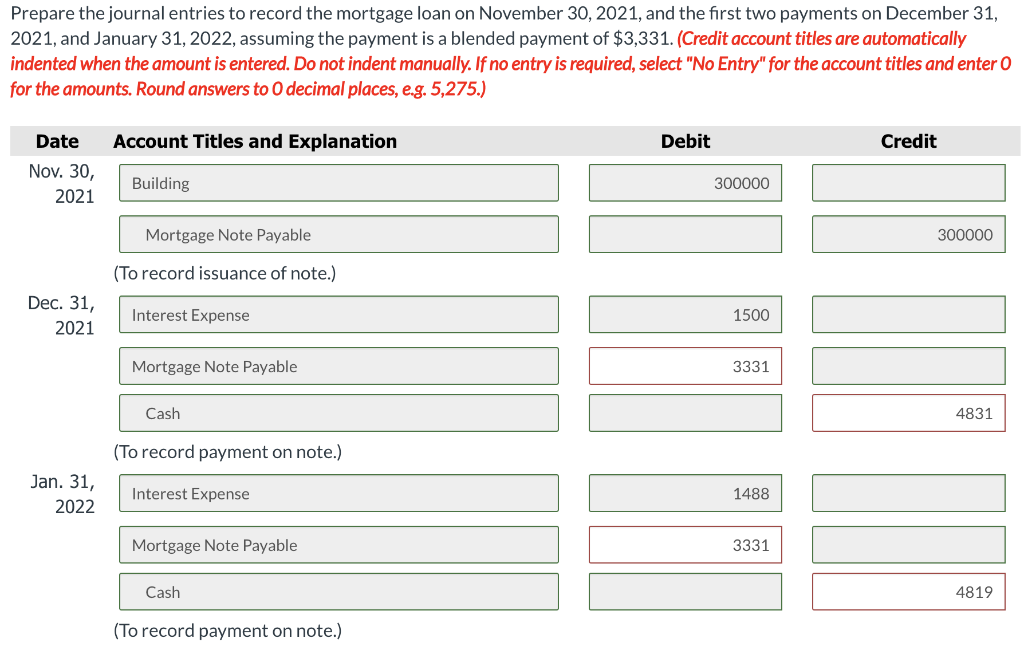

Solved Blossom Inc Issues A 300 000 10 Year 6 Mortgage Chegg Com

Solved On January 1 The Unpaid Balance Of A Company Chegg Com

Learn About Mortgage Note Chegg Com

Mortgage Broker Vs Bank Who Should I Choose Mortgage Brokers Online Mortgage Mortgage Tips

Best Parent Student Loans Choosing Private Or Plus Loans

Kahoot Play This Quiz Now Kahoot Teacher Technology Formative Assessment

Acc102 Chap10 Publisher Power Point

Solved Crane Company Purchased Land A Building And Chegg Com

Acc102 Chap10 Publisher Power Point

Printable Sample Personal Loan Contract Form Bad Credit Car Loan Contract Template Corporate Credit Card

Solved What S The Best Section Of The Mortgage Note It Chegg Com

/GettyImages-1133438028-28bdfa483acd4544a110002711c2f224.jpg)